Future backcast to Proposition : Reimagine financial credibility for digital nomads.

UX research / Service design / Speculative design

Initial project brief. Patch Kusonjai ©️2023

As part of the Future of Finance Challenge Lab, Me and my service designer fellow worked on this self-initiated project using curated service design tools and methodologies, in combination with backcasting speculative design process to expand our edges in the service design process through real context-based experiments.

⏐ CHALLENGE

The rewards of a nomadic lifestyle come with risks and challenges, especially financial mobility frictions. We want to navigate how banks and financial institutions could transform their propositions to help digital nomads, a growing population of the modern world (estimated to reach 1B in 2035!!), in building and maintaining their financial reputation throughout their nomadic journey to achieve holistic financial wellbeing.

⏐ RESEARCH METHODS

We conducted user research and supporting secondary research to understand digital nomads pain points, behaviours, values, and needs, from individuals and collective knowledge shared among online communities.

⏐ PROBLEM LANDSCAPE

The biggest problem underpinning everything is the outdated credit score system, which is being assessed from metrics that don’t suit the lifestyle and behaviours. Heavily influencing the main problem are two factors that trouble digital nomads most, according to their distinctive behaviours.

Rigid bureaucracy - depending on each border’s regulatory compliance and standard procedures. Their financial credibility is not transferred and recognised in new locations where they need to perform transactions.

Financial hustle - the fast-paced nomadic lifestyle that forces impulsive decisions and unpredictable expenses. Make it harder for them to keep track on their money management and credit building.

What we learned …

-

Digital nomads struggle to build their financial credits.

“ Somehow I feel like a financial outcast everywhere I go ... even in my home country ”

-

Different destinations, different regulations.

“From simply renting accommodations to acquiring visa and right to work …

It’s a whole new rules everywhere” -

Digital nomads are of different financial and life goals.

“I just want to experience it all while being able to build up my wealth … along the way”

How might we enable digital nomads to build and maintain their financial credibility while being on the move?

⏐ PERSONA

⏐ VISION & SCOPE

Our vision is to reinvent the credit score system to be more global and human focused, changing the intimidating process and system into an extensive reflection that enables a person to pursue what they need and want in life.

⏐ PUBLIC ENGAGEMENT & CONCEPT TESTING

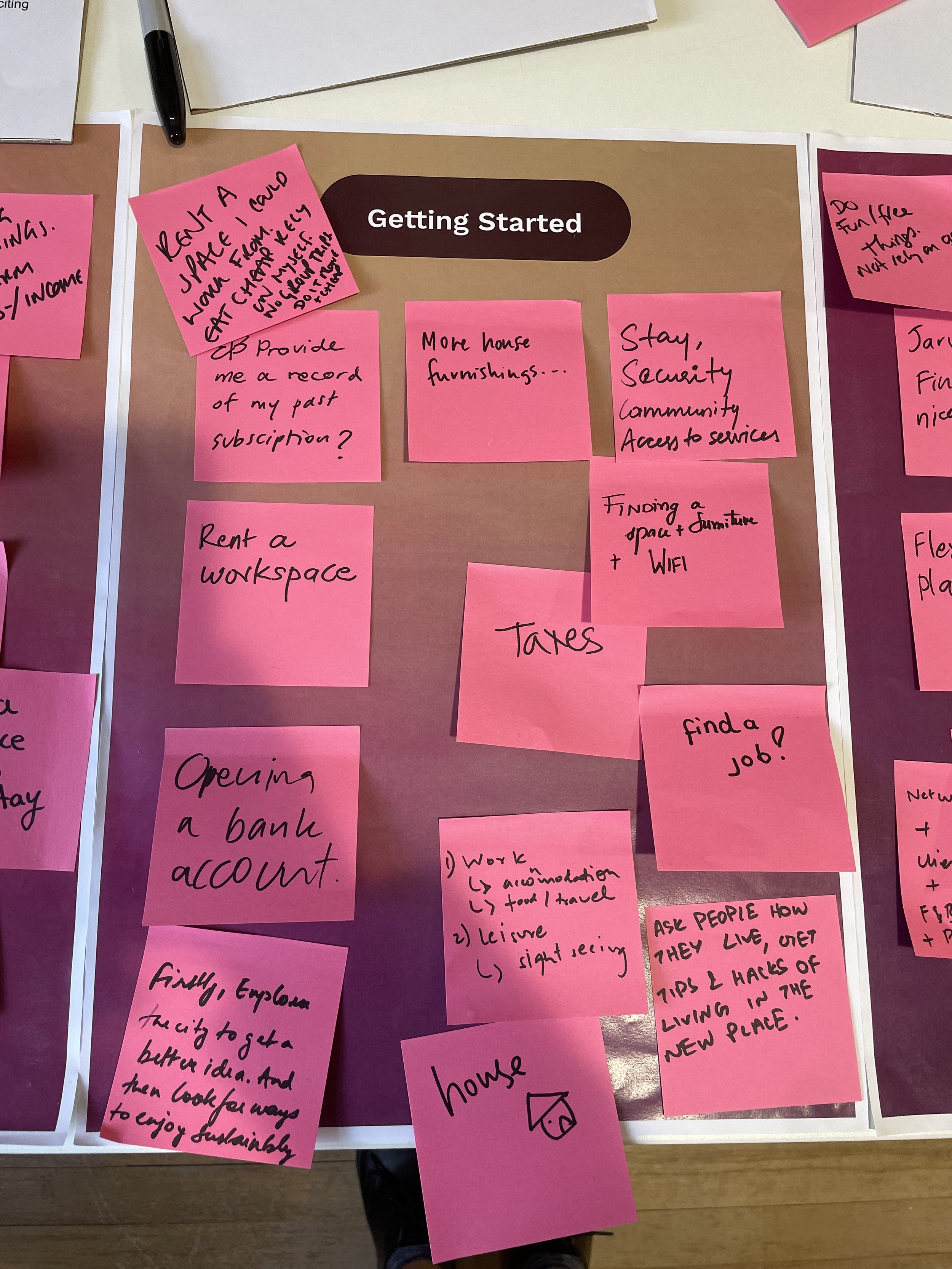

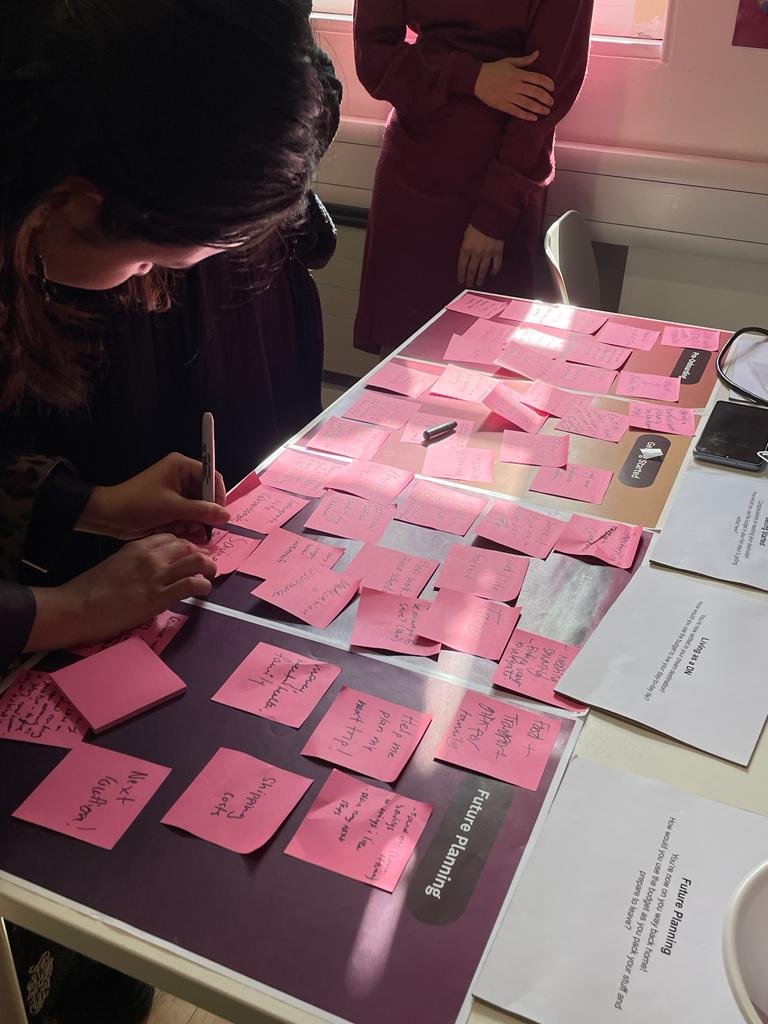

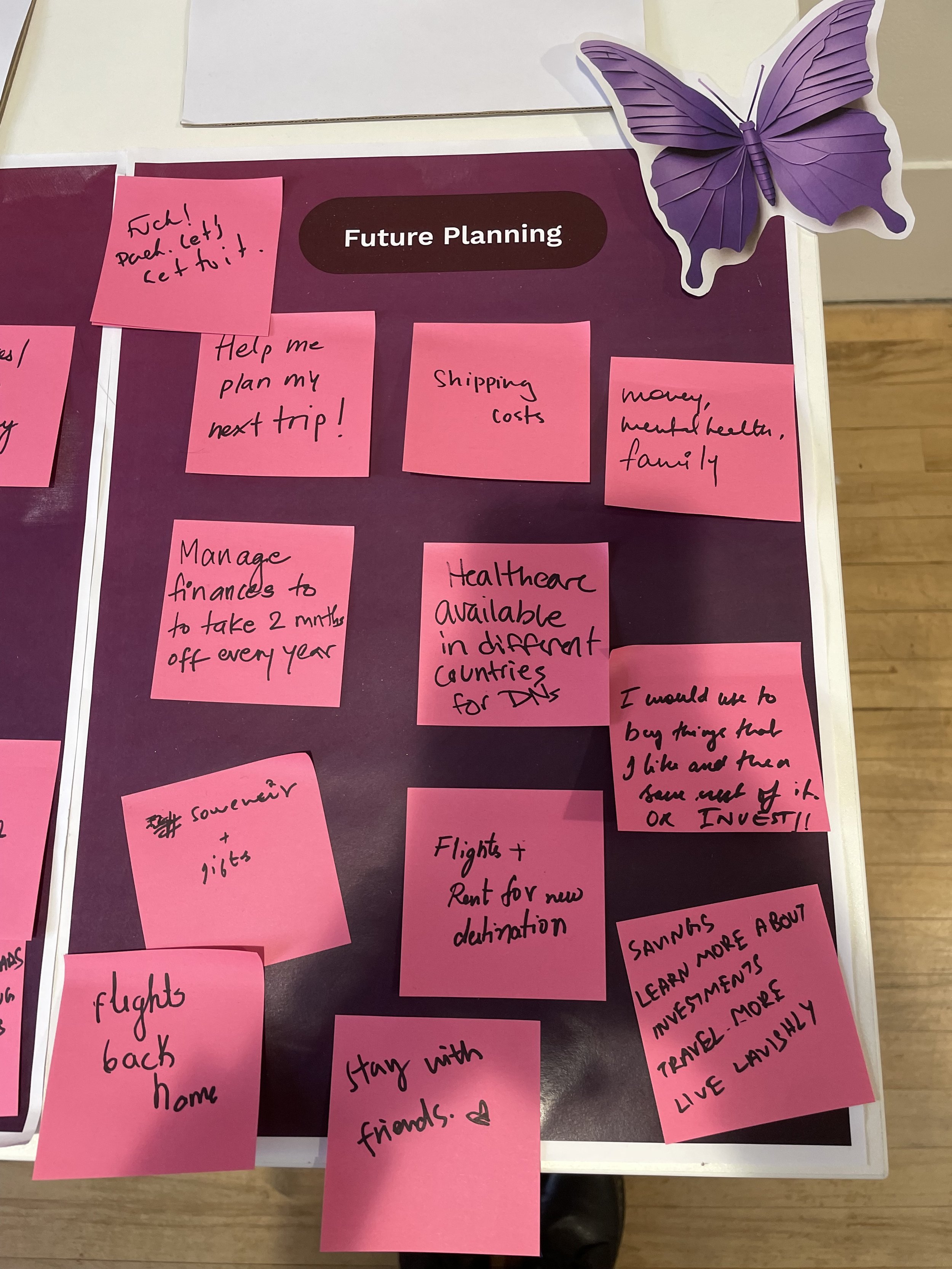

During the public event we hosted a small activity to have visitors imagine themselves as digital nomads. Going through different stages of pre-onboarding, getting started, living as a digital nomad and future planning, and imaging what could be things they need or want to do. While walking them through our initial concept, not for validation but to test if the concept draws interest and feels relevant to most people, which from our findings could contribute to the prospect number of digital nomads.

⏐ THE SERVICE IDEA

NomadCRED, is A service offered to digital nomads through multi-stakeholders partnership equipped with BaaS(Banking-as-a-Service) that provides embedded finance solution, utilising a person’s potential to build and maintain their portable financial credibility and reputation.

In this prototype the team bring up the specific use case of accommodation renting in the UK to go through features and values exchange between each stakeholders.

The growing butterfly concept aims to simplify and visualise how financial credits are collected and built up anywhere their wings reach, representing the nomads spirit and acting like their digital representations.

⏐ BUSINESS CASE & VALIDATION

We evidenced the business case by proposing these materials to potential stakeholders, and industry experts

value proposition for customers and stakeholders.

Business model & value exchange diagram.

Market size & estimated revenue growth.

Go-to-market strategy.

Key Performance Indicators(KPIs) and supporting measurement matrixes for the first year.

Feedback from one of our beloved digital nomads

“Love the butterfly model for credit scoring, it’s so much more human.. not just a number.. what does 600-700 even mean?!..”

Feedback from Refugee Support, British Red Cross